Credit Card Origination System

Turn Campaigns into Conversions

Call now: (844) 888-5565 Try the DemoGet more insight into the features and benefits that MK’s CCOS offers to Direct Issuers.

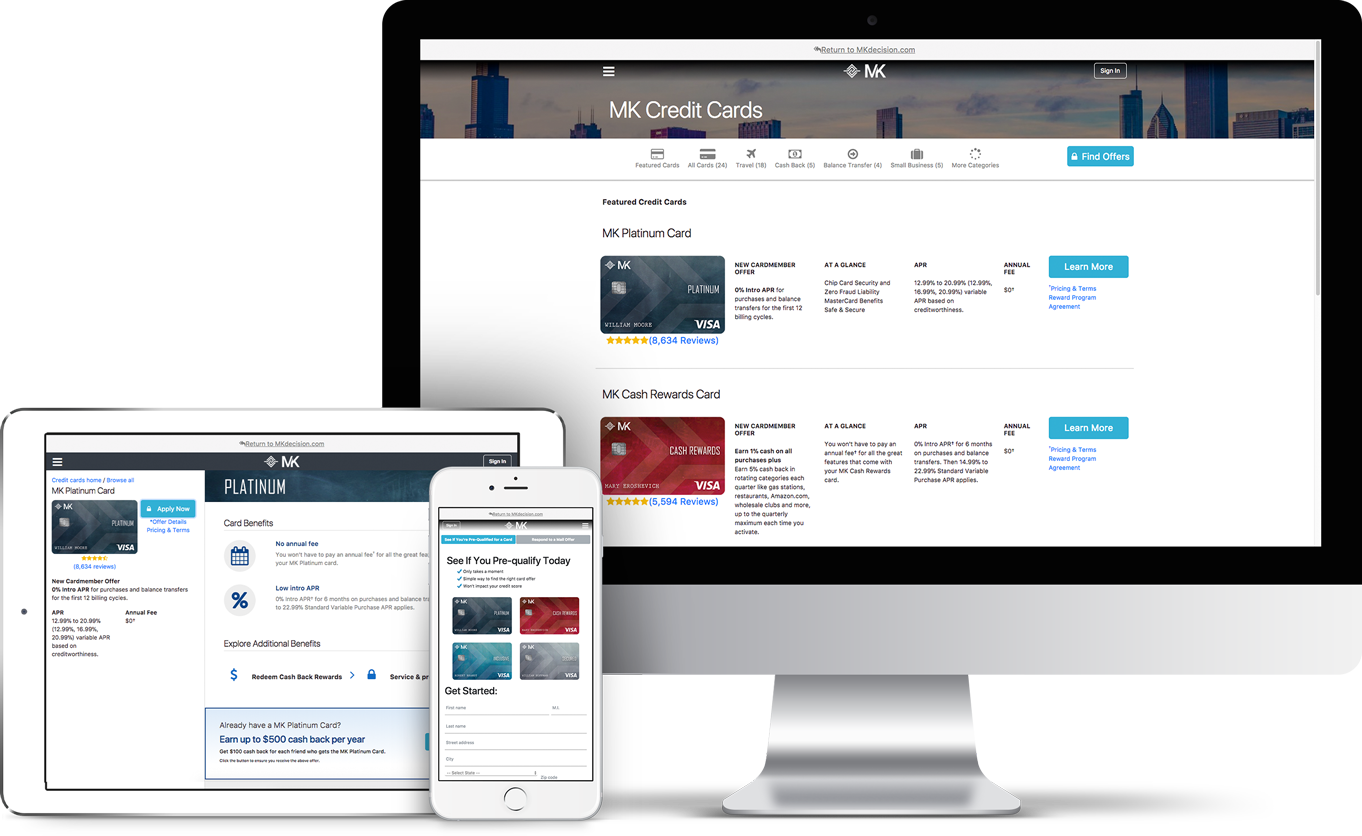

Direct Issuers benefit from MK’s end-to-end, white labeled Credit Card Origination System (CCOS) as they can now deliver a Bank branded user experience. Featuring mobile first design, supported on over 400 devices, MK offers effective, customizable Application Workflows.

Hosted on Amazon Web Services (AWS), MK’s cloud-based CCOS is a turnkey solution for credit card Direct Issuers. With existing Credit Bureau (i.e. Experian) and Bank Core (i.e. Fiserv) API integrations already in place, MK helps Banks rapidly launch to market.

Automated Decisioning is MK’s core competency; saving Bank customers time and keeping them from shopping their credit with competitors. Customizable credit risk models provide Banks the flexibility needed to adapt to current market conditions while machine learning safeguards from human error.

Rapidly launch campaigns with “out of the box” implementations for: PreScreen invitation codes, PreQualify customers with soft pull credit reports, and Secure Card funding. Partner with MK to turn your campaigns into conversions.

MK’s proprietary Appshield protects identity and prevents fraud by filtering invalid data entries and repeat applications.

Automating Bank Secrecy Act regulations (OFAC, CIP, AML) and instant, secure digital messaging for Adverse Action Letters and Risk-Based Pricing Notices satisfies today’s compliance regulations in a lean and scalable fashion. Additionally, multi-regional server redundancy ensures Banks have disaster recovery when they need it most.

In light of recent Credit Bureau data breaches, MK takes pride in its Experian Independent Third Party Assessment (EI3PA) certification. MK uses modern encryption and cryptographic protocols (TLS 1.2) when handling sensitive consumer data and implements Multi-Factor Authentication for identity verification and fraud prevention.

Real-time reporting & analytics allow Banks to create future campaigns by analyzing past results. With inline and page level analytics, MK’s COOS enables you to make data-driven decisions in an age where information is currency.